Author: Contributor

-

LeBron James didn’t ask to be the face of the NBA, now he’s calling for change

Melissa Rohlin FOX Sports NBA Writer LeBron James is over the negativity. In light of Anthony Edwards saying during All-Star weekend that he doesn’t want to be the next face of the league, this reporter asked James on Thursday if that role was something James even wanted – or whether it was just bestowed upon…

-

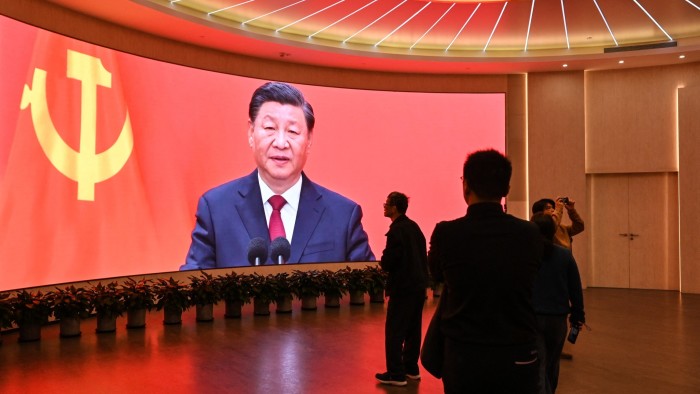

Military delegates lose sway at China’s signature political gathering

Stay informed with free updates Simply sign up to the Chinese politics & policy myFT Digest — delivered directly to your inbox. The size of the military delegation to China’s rubber stamp parliament is falling and may shrink further, as leader Xi Jinping’s purges cast a shadow over Beijing’s biggest annual political event. The military…

-

Green Dot Partners With Marqeta to Expand Cash Deposit Services Across 95,000 Retail Locations

Green Dot (NYSE: GDOT) and Marqeta, Inc. (NASDAQ: MQ) have announced a strategic collaboration to enhance cash services across the United States. The partnership leverages Green Dot’s extensive network of over 95,000 retail locations nationwide, enabling convenient cash deposits for Marqeta’s customers. The collaboration addresses the persistent demand for cash services, particularly…

-

I replaced my iPhone 16 Pro with the 16e for 24 hours – here’s everything I learned

Sabrina Ortiz/ZDNET Apple finally brought back its entry-level phone, the iPhone 16e. The three-year gap from the previous model release gave Apple time to implement a big refresh, including the addition of Apple Intelligence, supported by the A18 chipset, an Apple modem, a larger battery capacity, more storage options, and Face ID, to name a…

-

American Airlines to trial free Wi-Fi on 3 routes

Wi-Fi for $35 on a cross-country flight? That’s currently the going rate on American Airlines. However, changes might be on the way. The Fort Worth, Texas-based airline is officially trialing free Wi-Fi beginning next week, the airline announced internally on Friday and also confirmed with TPG. The test will cover just three routes (in both…

-

Rubio says Zelensky should apologize following Oval Office meeting

CNN — US Secretary of State Marco Rubio said Ukrainian President Volodymyr Zelensky should apologize after his meeting with President Donald Trump in the Oval Office devolved into what Rubio described as a “fiasco,” while questioning whether the Ukrainian leader really wants peace in the country’s war with Russia. In an exclusive interview with CNN’s…

-

I wish Monster Hunter Wilds’ open world and changing seasons were ambitious enough to justify its PC performance woes, but they’ve yet to truly wow me

As I write this on Friday, more than 1.3 million people are actively playing Monster Hunter Wilds on Steam. So far only around 13,000—or 1%—have stopped playing long enough to review it, but those who have are largely frustrated. Steam reviews sit at a disappointed “mixed,” largely citing performance issues as the reason. And I…

-

Even with the upcoming category changes, there’s still plenty of value in World of Hyatt points

It’s becoming an annual tradition. Each February or March, World of Hyatt announces its annual category changes about a month before implementing them. As soon as Hyatt releases the list of category changes, loyalists — myself included — carefully examine the list to see if properties we love or hope to eventually visit will soon…

-

Is Web3 Ready To Revolutionize Healthcare?

Late last year, the U.S. Department of Health and Human Services (HHS) took a bold step toward modernizing healthcare data exchange by finalizing The Trusted Exchange Framework and Common Agreement (TEFCA). This initiative aimed to enhance equity, innovation, and interoperability by facilitating the secure exchange of electronic health records (EHRs). At its core, TEFCA sought…