Author: Contributor

-

Donald Trump Praises Keir Starmer as ‘Particular’ After Criticizing US Allies

Since taking workplace, Donald Trump has usually criticized America’s long-standing allies. Nonetheless, on Thursday, he took a noticeably completely different strategy, showering Britain with reward and warmly welcoming Sir Keir Starmer as his “particular” visitor. Trump described the UK prime minister as a “particular man,” King Charles as “an exquisite man,” and Starmer’s spouse Victoria…

-

With Biden Safely Out Of Workplace, CNN’s Jake Tapper Lastly Decides To Examine The Former President’s Psychological Decline

Credit score: Screenshot by way of CNN CNN’s Jake Tapper and Axios reporter Alex Thompson are publishing a hard-hitting guide analyzing former President Joe Biden’s psychological decline and the cover-up concerned behind the scenes to maintain it quiet. Regardless of years of proof that Biden’s cognitive skill was severely hindered even within the earliest…

-

Trump Celebrates ‘Obnoxious’ Pleasure Reid Getting Canceled by MSNBC

Credit score: Screenshot through Sky Information Australia President Donald Trump danced on the stays of Pleasure Reid’s profession at MSNBC after it was introduced that the controversial host had been fired. Reid was given the dangerous information earlier this week, along with her present set to air its remaining episode someday within the coming days.…

-

Come See Me on Guide Tour!

Saving Cash for Journey: The best way to Keep away from Pricey Financial institution Charges Overseas Saving up for journey is without doubt one of the greatest hurdles individuals face earlier than embarking on a visit. It could actually take years to fund that dream trip! However as soon as vacationers lastly hit the highway,…

-

The Secrets and techniques to Getting Signed by Defected Data, Based on Label's Head of Music

For a lot of producers, touchdown a launch with Defected Data is a dream. However with numerous demos submitted day by day, it is troublesome to determine what to do to make your submission stand out. In a latest Defected publication shared with EDM.com, the label’s Director of Music, Andy Daniell, shared his insights into…

-

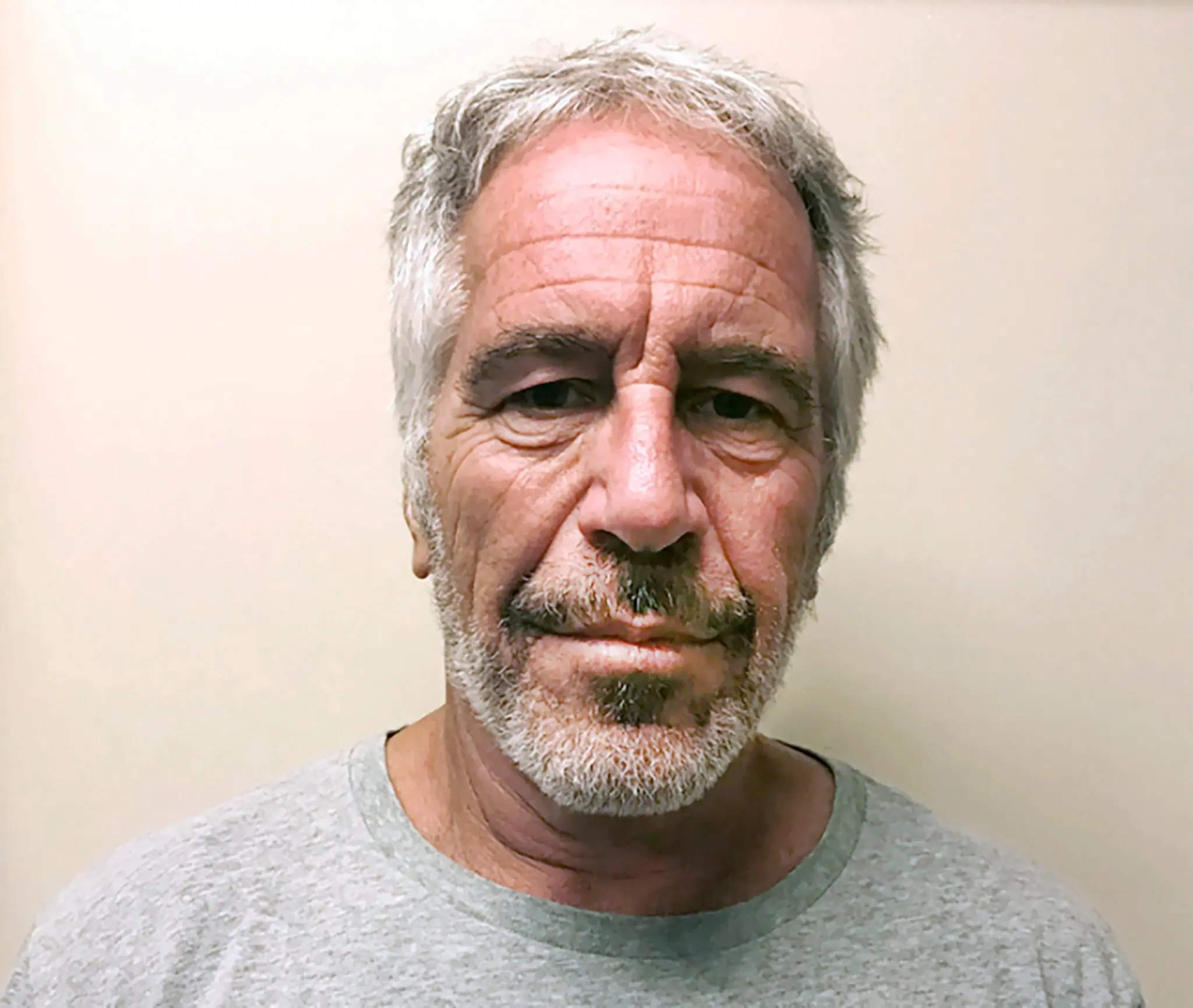

BREAKING: DOJ Releases ‘Section One’ of Epstein Paperwork — Flight Logs, Proof Checklist

Convicted pedophile Jeffrey Epstein U.S. Division of Justice launched the primary section of the Epstein Information on Thursday night. “This Division of Justice is following via on President Trump’s dedication to transparency and lifting the veil on the disgusting actions of Jeffrey Epstein and his co-conspirators,” stated Lawyer Common Pamela Bondi. “The primary section of recordsdata…

-

The most popular AI fashions, what they do, and methods to use them

AI fashions are being cranked out at a dizzying tempo, by everybody from Massive Tech corporations like Google to startups like OpenAI and Anthropic. Conserving observe of the newest ones could be overwhelming. Including to the confusion is that AI fashions are sometimes promoted based mostly on business benchmarks. However these technical metrics usually reveal…

-

Why Did Trump Put Tariffs on Canada? Discover Out the Motive

Picture Credit score: Getty Photos President Donald Trump is ready to renew the substantial tariffs on imports from Canada, Mexico, and China that he first imposed in early February. “The proposed TARIFFS scheduled to enter impact on MARCH FOURTH will, certainly, go into impact, as scheduled,” Trump wrote in a Fact Social submit. Nonetheless, Trump has…

-

Quantum computing is struggling to succeed in its silicon second

Unlock the Editor’s Digest at no cost Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication. In 1947, the primary transistor, the fundamental constructing block for a digital laptop, was made utilizing a semiconducting materials regarded as perfect for the duty: germanium. The concept of utilizing silicon didn’t come up…

-

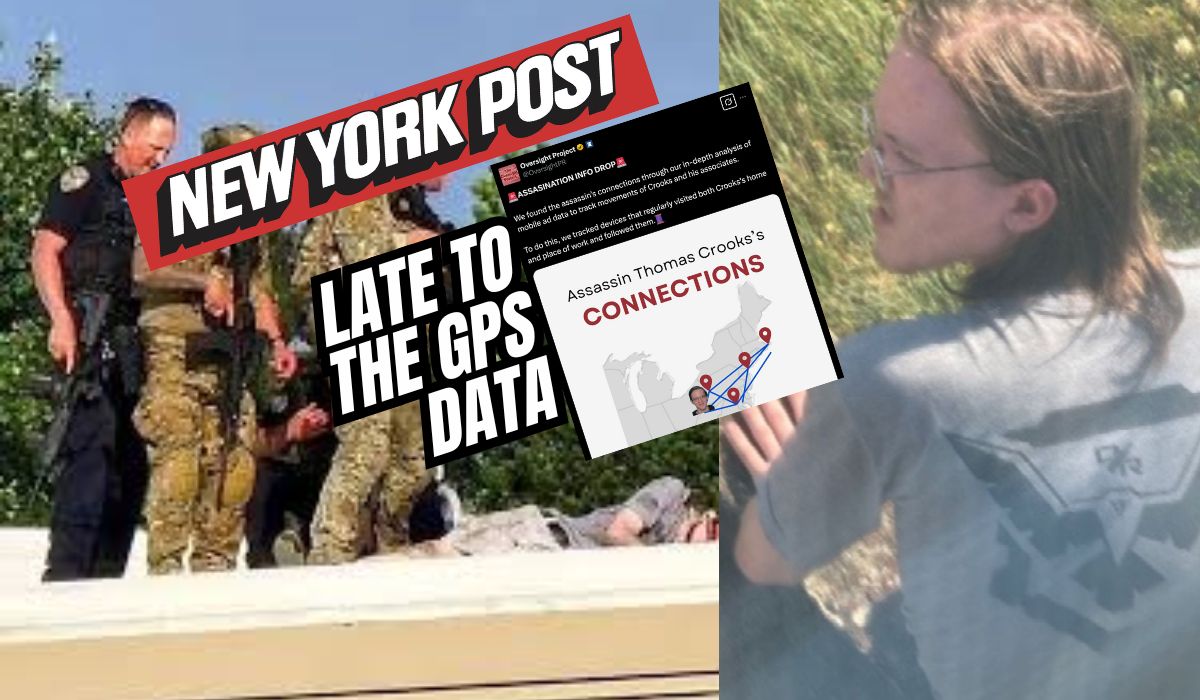

NYPost: Thomas Crooks Could Have Had Confederate, FBI Stonewalling — Ignores Apparent Proof from July of Accomplices, FBI Lies, Doable FBI Involvement | The Gateway Pundit

The New York Put up is publishing what their reporter Dana Kennedy is falsely calling an unique, citing geofencing and knowledge evaluation that reveals that alleged Trump murderer Thomas Crooks had an confederate. The New York Put up is giving its readers an unique six months late to this facet of the story, and with…