Author: Contributor

-

13 Things To Know Before Playing

Monster Hunter Wilds is the most streamlined game in Capcom’s long-running action-RPG series. Worried that juggling menus and harvesting laundry lists of arcane animal parts sounds too overwhelming and boring? Fear not! Monster Hunter Wilds lets you (mostly) make the experience as simple or as complicated as you want. Dive in deep and get your…

-

The best places in the world to see cherry blossoms

After a long, gray winter, few things can lift my mood like seeing the first pink cherry blossoms of spring fill the sky. I’m especially lucky — some of the best buds on the East Coast bloom near me at Branch Brook Park in Newark (yes, that Newark). The 5,000 trees create a cotton candy…

-

GOP to Avoid Town Halls After Viral Angry-Voter Exchanges

Federal workers and protesters speak out against President Donald Trump and Elon Musk, who is leading the so-called Department of Government Efficiency, and their push to gut federal services and impose mass layoffs. Photo: Michael Nigro/Pacific Press/LightRocket/Getty Images At congressional town halls across the country over the past two weeks, Republican members of Congress have…

-

Bill to legalize online sports betting absent as Crossover Day approaches

Dave Williams | Capitol Beat News Service Supporters of legalizing gambling in Georgia may have to wait until next year for the General Assembly to act. With less than a week remaining before Crossover Day – the deadline for legislation to pass either the Georgia House or Senate to remain alive for the year –…

-

VA Study of Brain Injuries and Mental Health Would Be Ordered Up by Senate Bill

Key senators, including the chairman of the Senate Veterans Affairs Committee, are renewing a push for an in-depth study of how brain injuries affect veterans’ mental health. Chairman Jerry Moran, R-Kan., and Sen. Angus King, I-Maine, who also sits on the committee, reintroduced a bill this week that would direct the Department of Veterans Affairs…

-

Steph Curry has been awakened, and that’s scary news for the rest of the NBA

Feb. 27, 2013: Steph Curry declared himself arrived. The NBA’s newest superstar. Scoring 54 in Madison Square Garden was a launch party. He and his Golden State Warriors would go on to upset Denver and press San Antonio in his postseason debut. Feb. 27, 2016: Steph Curry declared himself a transcendent figure with a defining…

-

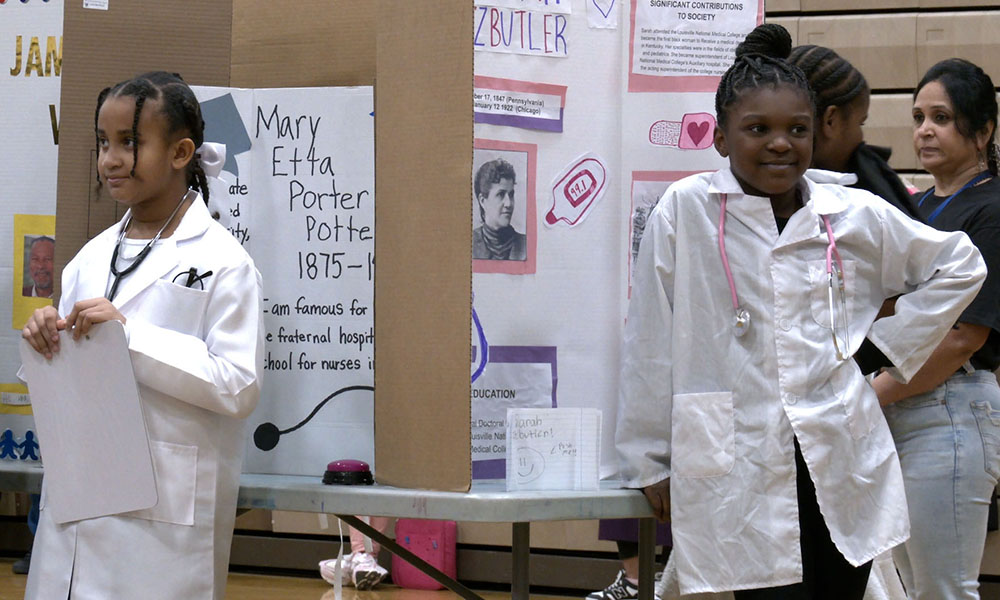

Students honor West Louisville’s health care pioneers

Inspired by the historical monument at Norton West Louisville Hospital, elementary students brought history to life. Author: Norton Healthcare Published: February 28, 2025 Estimated reading time: 4 minutes History was alive at Brandeis Elementary School in Louisville, where students participated in their annual “living wax museum” honoring historical African American heroes during Black…

-

2025 NFL Mock Draft: Giants trade up to No. 1 after missing out on Matthew Stafford; defenders dominate top 10

Miami (FL) • Sr • 6’2″ / 223 lbs Projected Team N.Y. Giants PROSPECT RNK 8th POSITION RNK 1st PAYDS 4313 RUYDS 204 INTS 7 TDS 43 The Giants are reportedly one of the teams interested in Matthew Stafford, but in this mock draft, they miss out on the 37-year-old signal-caller. As a result, they…

-

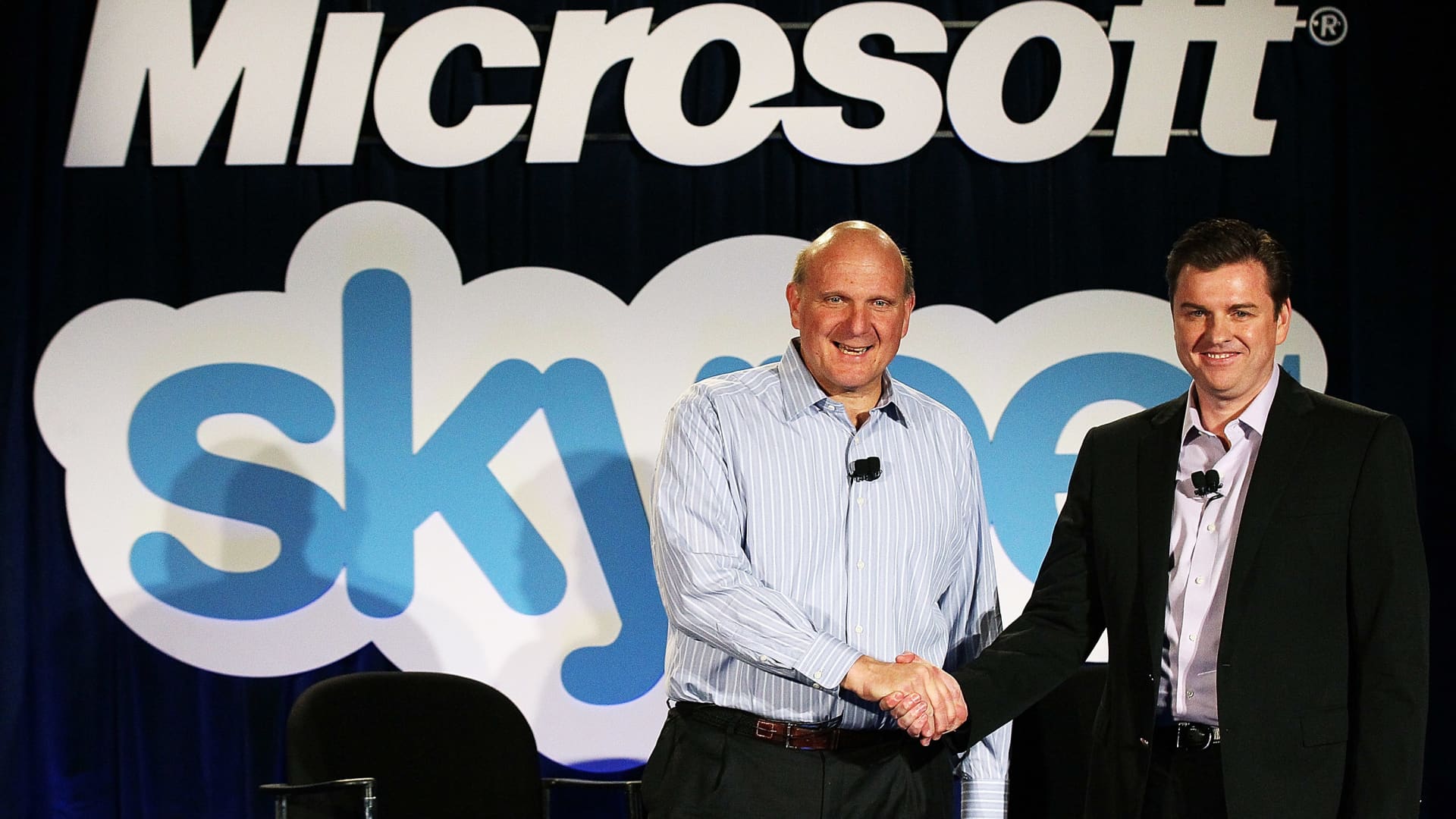

Microsoft is retiring Skype in May, encouraging people to adopt Teams

Kelly Harris of San Jose, leans over to kiss the web cam as she says her goodbye to Brian Johnson, her brother stationed in Japan, at the end of their video phone call via Skype in San Jose, Calif. on Nov. 25, 2009. Lea Suzuki | San Francisco Chronicle | Hearst Newspapers | Getty Images…

-

Apple Watches are hitting the ice in latest sports push

Apple (AAPL) is deepening its push into sports, adding its Apple Watch to the list of its products that can be found in and around major league teams. The tech giant and the NHL announced on Friday that referees have been using the Apple Watch throughout the current season as a means of monitoring the…